Articles

Lessons to

strengthen your

financial footing

in 2021

1st January came and you made your resolutions. Some of you have kept them, others have not. But taking that first step is all that matters.

In 2021, elevate your game and strive to be more independent. It's been a month since 2021 began, but the worries of 2020 still persist.

So, let's learn a few steps in 2021 to become more financially resilient and of course, independent.

Cut out on expenses

2020 hasn’t been an easy year for anyone. Salaries were cut, people lost their jobs and many didn’t even receive a pay check when they completed a project. But it did give you an opportunity to better understand your relationship with your money. It enabled you to spend on what is necessary and what is not.

The best way to cut expenses are by tracking them. So, do look at what you spend on, review your bills (phone, electric and gas) and cut out anything you don’t require. Also, figure out fun apps and computer tools that can help track your expenses.

Boost your savings

You may have heard a couple of your friends or family members telling you that last year they had to break their fixed deposits and withdraw from their mutual funds, because of a lack of funds. It was a good reminder to always save, especially during a pandemic.

So even though 2021 feels optimistic, it’s time for a reality check. The job ahead for the government will not be easy and it will take time for the vaccine to reach everyone. And even once it does, businesses will still take time to recover. But it doesn’t mean you should stop saving. If you already have investments in various financial instruments, re-evaluate how much you can invest and continue to do the same. You don’t want to just invest for the future and not have anything for the present.

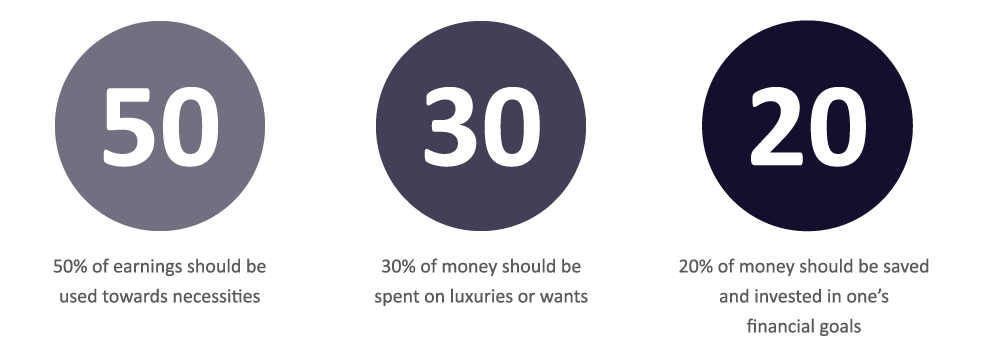

The 50/30/20 rule of financial planning

Manage your cards

With the pandemic and cash not easily available, many started using their credit cards. This has lead many to fall under credit card debt. It’s important to remember that credit cards carry the highest form of debt and charges when bills aren’t paid on time. After all, in the long run, it will not just be your credit score that will matter but also your overall credit profile, especially when searching for any kinds of loans. So, use your credit cards only during an emergency.

Some ways to be smart with your credit cards

Plan and take advice

This is your life to live, so live it wisely. Make your own plans and follow your ambitions. Go for all your dreams - travel, buy a bike and so much more. So, it’s time you came up with a financial plan that is best suited to you.

As much as you would prefer running on your instincts, you first need to learn, do a bit of research and take advice. Financial jargon is not everyone’s forte, but there is always someone who can break it down for you. For starters, consult a financial planner. Aside from helping you make sound investment choices, they will help you plan for unforeseen emergencies and save for personal goals. Do visit a financial planner to make the right investments in the long and the short run.

Become entrepreneurial

2020 has had its downs, but there have also been ups. If it has taught us anything is that if you are passionate about something, you can do it. So, go for it. Take up a side job, work a little longer, work on weekends and have a few more late nights, but go for your dreams. After all, isn't this what you are striving for?